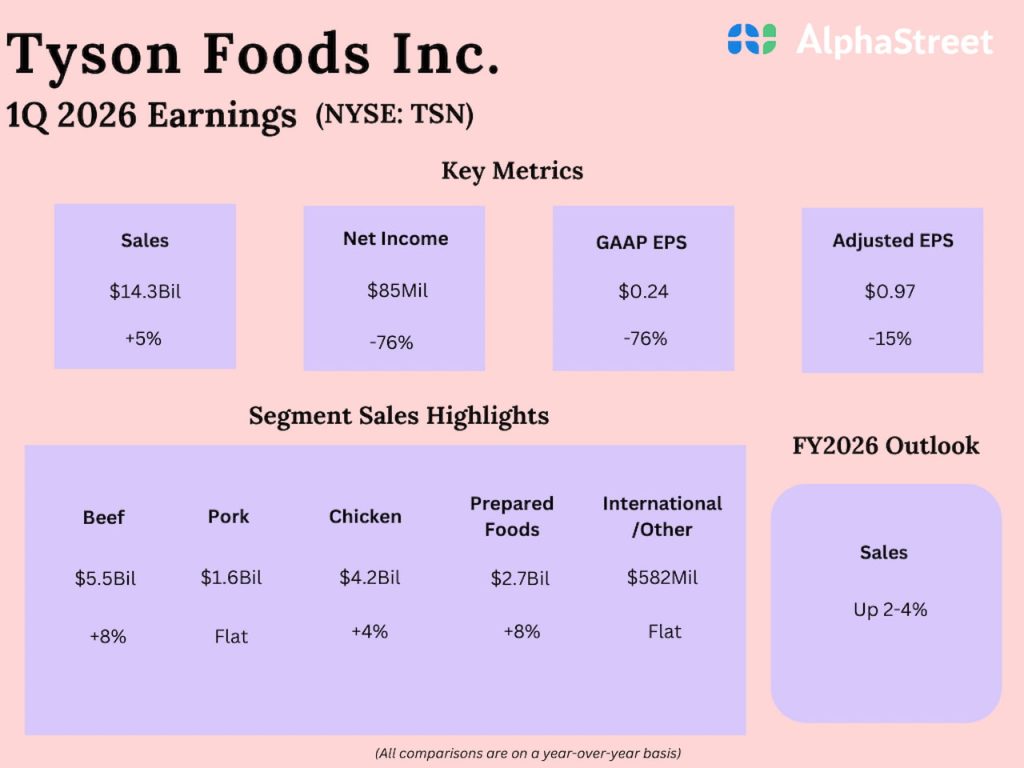

Tyson Foods, Inc. (NYSE: TSN), a leading processor and marketer of chicken, beef, and pork, on Monday reported higher sales and lower earnings for the first quarter of fiscal 2026.

Total sales came in at $14.3 billion in the December quarter, compared to $13.6 billion in the year-ago quarter. The top line exceeded analysts’ estimates.

Earnings, adjusted for special items, decreased to $0.97 per share in Q1 from $1.14 per share last year, but beat expectations. Net income attributable to Tyson was $85 million or $0.24 per share in Q1, compared to $359 million or $1.01 per share in Q1 2025.

For fiscal 2026, management expects total company adjusted operating income to be in the range of $2.1 billion to $2.3 billion. Full-year sales are expected to grow between 2% and 4%, compared to fiscal 2025. The guidance for FY26 cash flow is between $1.1 billion and $1.7 billion.

“Prepared Foods delivered top and bottom-line growth while Chicken reported its fifth consecutive quarter of year-over-year volume gains. As protein demand continues to increase, our consistent share gains demonstrate we are well-positioned to capture this momentum. I’m encouraged by the progress we’ve made and confident we will drive continued improvement across the controllable aspects of our business in fiscal 2026.” said Donnie King, President and CEO of Tyson Foods.